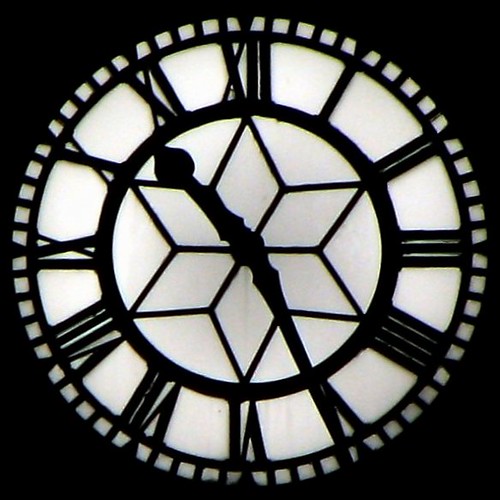

Beware of the 11th Hour!

Isn’t it fun? Each and every day there is something that has changed in real estate in San Diego or throughout the US and you better be on your A-game, because in this industry what you don’t know WILL hurt you.

Isn’t it fun? Each and every day there is something that has changed in real estate in San Diego or throughout the US and you better be on your A-game, because in this industry what you don’t know WILL hurt you.

So, in an effort to minimize “bad loans”, Fannie Mae is asking lenders to take more responsibility for their files. Most things won’t be much different for you, most of these rules will be extra work for your loan officer like social security number validation checks.

There is, however one major consumer issue:

The 11th Hour Credit Score Re-pull

In the current market that we’re in, Fannie Mae wants all loan officers to verify that an applicant’s credit profile did not change while the loan was being reviewed by underwriters. For those of you that don’t speak real estate geek terms, the underwriter is the person who oks your loan.

If your profile changed then Fannie Mae may refuse to take the loan which means a loss for the bank.

Obviously the less risk the bank takes on the better, so loan officers will be doing a complete re-pull of your credit report just before closing.

Here is what banks are going to be looking for:

1. Did you apply for new credit cards?

2. Did you run up existing credit cards?

3. Did you finance an automobile or other major purchase, so do not go get a Mercedes Benz.

If Fannie Mae sees that the most recent credit report shows inconsisitencies with the the original credit report, the mortgage is subject to a complete re-underwrite and a possible turndown.

Right now I know that they have not started doing this at Bank of America yet but it is in the works and should be in effect soon, not sure of how many banks have started the procedure.

In any case, if you are thinking about a big purchase, please wait until you get those shiny little keys in your hands!

[…] Beware of the 11th Hour! […]