Has Anyone Heard This Bit Of News Regarding This Mortgage Mess We're In?

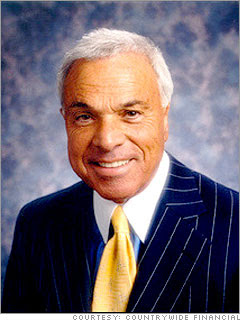

I wonder if Mr. Mozilo is still smiling?

How many of you know who Angelo Mozilo is? Ever hear of a company called Countrywide? I can already hear all of your uh-huh’s and oh yeah’s. Well unless you’ve been under a rock you’ll remember that this individual was the CEO of Countrywide loans. Countrywide became one of the largest mortgage companies in the country especially in the most recent real estate boom. They were arguably the poster child for subprime and creative financing loans in the United States.

I, as I’m sure lots of people as well, wondered what had become of Mr. Mozilo and more importantly if any disciplinary action had ever been taken against him. Once the mortgage debacle occurred his company was criticized for being a large contributor to the subprime mortgage mess. It was also questioned if any fraudulent business practices were committed by the company.

Well here’s an update on what has resulted in recent days. It seems that the SEC has investigated Mr. Mozilo and his company and are now preparing to bring criminal charges for hiding the problems of the companies portfolio of risky loans. The SEC is preparing to move forward to trial but it’s been announced that a settlement might be reached before the trial begins. I’m sure many of you will be interested in the outcome of this big news story. I’m looking forward to reading what’s sure to be tons of very interesting comments on this post. This is one story’s ending I will be sure to update as soon as I can find the outcome. Stay tuned for more!

Well it looks like he got what some call “a slap on the wrist”. For insider trading the SEC is imposing a 67.5 million fine, however, he walked away from Countrywide with a cool 140 million. It ain’t over yet–the District Attorney General’s office in L.A. is seeking Federal Criminal charges against him. He may have a new place of residence in the future–behind bars!